Builders are paying stamp duty in their own name. Purchasers may face loss of lakhs.

Remember the time when the builder asked you for an amount which included several fees and charges before agreement registration and you promptly like a good purchaser transferred the amount. After all what does a layman know about the legal formalities, you completely trust the builder developer and are excited for the sale agreement registration, then who cares how much is the stamp duty and registration fees that has been paid under your by the builders? And what does it matter if he has paid the stamp duty in his name? It’s not like that will affect you or cause you a loss.

What if it is causing you a loss? A loss of Lakhs of hard earned money, what then? Most of the purchasers have convinced themselves that nothing will go wrong, the transaction will be smooth and it will be completed. These property buyers never for a second wonder about preparing for unfavorable events. From the bank denying a property buyer loan to the builder going broke, there are numerous reasons for your property transaction to not be completed. Pretending that such events will never happen to you is gambling away lakhs and lakhs of your hard earned money. You may wish that you have to never face such challenging times but wishing will not secure your money and rights.

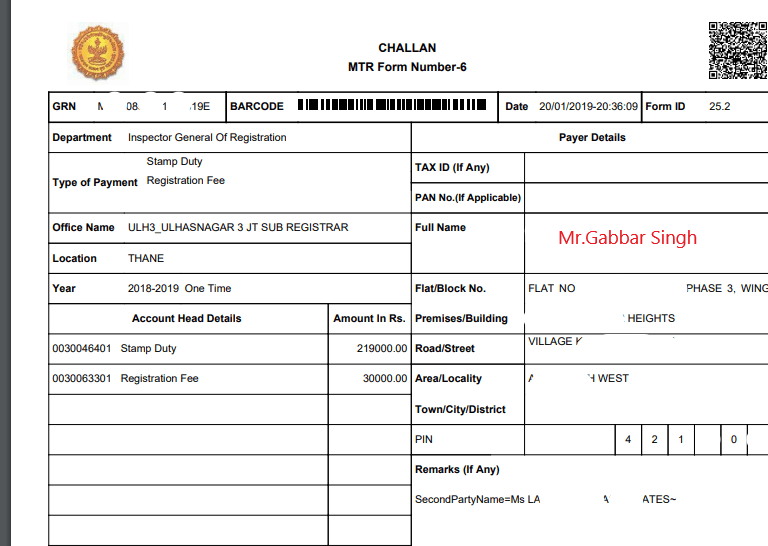

Did you know that in an event of cancellation only the person/ entity who has paid the stamp duty is entitled to apply for a refund of the stamp duty amount? Did you also know that the stamp duty payer is a person whose name is mentioned on the GRAS Challan or ESBTR Certificate (receipt of stamp duty payment/s)? More and more builders enter their name as the duty payer which means that even if you have given the builder amount for paying stamp duty and since you did not enquire with your builder about whose name has been mentioned on the challan, you have thrown yourself at the builder’s mercy.

In such case only the builder is eligible to apply for a refund of stamp duty amount and that is if the builders feel so. Since it’s your money at stake you will have to beg and plead the builder to file the refund application within time. And if you convince them to do so then you will have to cross your fingers and hope that the application is without any faults else the application will be pending for months or even years. If you manage to take time out of your busy schedule and keep relentless follow up of your case with the builder then your amount may be reimbursed by the government within a couple of months, strictly depending upon the amount of stamp duty. The amount will be transferred to the builders account and you will have to again plead with the builder to transfer the same to you which if you are lucky may take a couple of months. And this is if the builder is generous enough not to deduct the said amount under arbitrary or vague clause that you in your carelessness have signed for.

Solution

1) If you are a property buyer who has recently provided the booking amount and have transferred additional amount for registration, maintain a written communication with the sales/legal team of the builder and ask them to pay the stamp duty in your name. Kindly understand that your name must be mentioned as a duty payer and not as the other party or second party.

2) Always ask for a copy of the stamp duty challan to be mailed to you before registration. Please discourage pictures on whatsapp and insist for a pdf copy to be sent to your mail.

3) If the builder has despite all your requests entered his name as the duty payer insist that he enters a clause in the sale agreement that in case of cancellation he will apply for stamp duty refund within a period of thirty days from the day and date of registration of cancellation deed and will be responsible for weekly follow of the refund application, appropriate and satisfactory reply to any queries raised by the government within 15 days of the queries so raised and completion of the stamp duty process within 90 days of the said day and date of the stamp duty application.

4) Furthermore insist upon the clause that the builder will transfer the stamp duty amount received from the government to you within 3 working days of such transfer in his account without any deductions.

A Gras challan for stamp duty looks like this:

Our team hopes that this information will serve you in your property transaction and you will take informed decisions to your benefit. If you have any queries regarding the property registration, documents, kindly write to us at info@legalcounter.in. For queries regarding stamp duty refund, kindly write to us at info@estampdutyrefund.com. Hit like on our Facebook post and share it so that it may help others like us. Thank you

This article is brought to you by estampdutyrefund.com